Pdt Rule if You Buy and Sell and Buy Again Does It Count as 2 Day Trades

The Blueprint Solar day Trader Rule (PDT Rule) is one of the near common grievances amongst new traders.

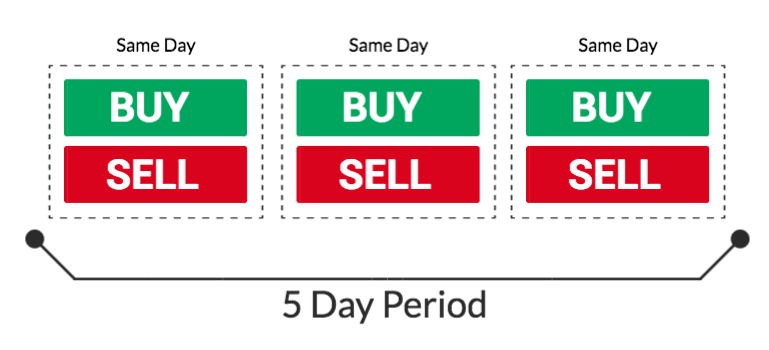

This FINRA rule states that traders with less than $25,000 in their accounts are express to three day trades (known as "circular trips") in a five twenty-four hours rolling flow . Failure to attach to this rule will result in a 90-day lock on a trader'due south account, during which a trader'south funds volition exist frozen.

This rule was designed to prevent less-sophisticated traders from "gambling" in the markets, and although FINRA would claim this rule is a protective measure, many new traders adamantly disagree.

For our purposes, we're not going to debate the merit of the PDT Rule. It'southward a reality of trading that you lot're better off accepting.

Today, nosotros're going to put this dominion into perspective and discuss a few tips & tricks.

Putting Things in Perspective

Before we go to some actionable insights, let's put things in perspective.

If you are trading nether the PDT rule, there are ii possible scenarios:

- Y'all are profitable

- Yous are losing money

Scenario 1: You are Assisting

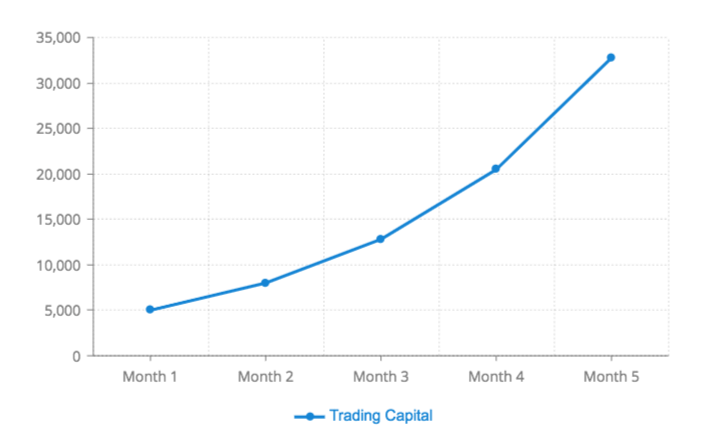

Let'southward presume y'all are trading profitably with a $5,000 business relationship and going "all in" on every trade. If you boilerplate a 5% win, you can brand $250 per merchandise. With 3 weekly trades, this would equate to a monthly return of threescore%. Within five months (accounting for compounding), you would featherbed the PDT rule. During the preceding period, yous would develop field of study and patience, and these v months of "express" profits would exist a speck in your fruitful trading career.

Scenario two: Yous are Losing Money

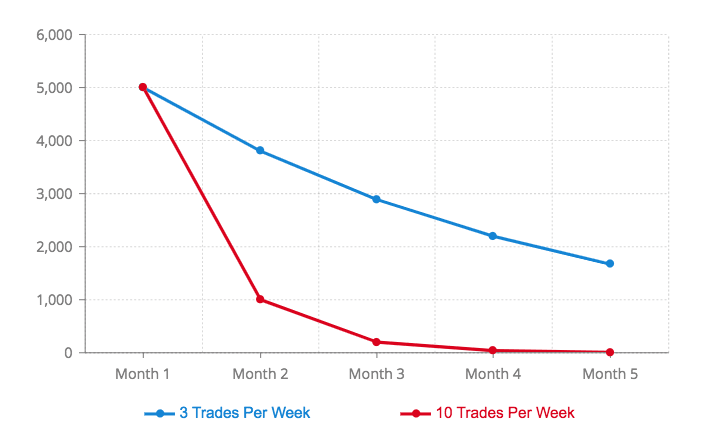

Allow's assume you are losing money in a $v,000 account and going "all in" on every merchandise. If you average a 2% loss, you lose $100 on every trade. With three weekly trades, this equates to a 24% loss every month. In this case, it makes little sense to place more than trades, as every trade yous identify is draining your uppercase. In this case, the PDT rule is actually protecting you lot from yourself. The rule is helping you limit your losses at a time when y'all are however learning.

With this perspective, the PDT rule is a temporary roadblock for assisting traders and a benign restriction for unprofitable traders.

Here are some tips both groups tin can utilise to navigate the PDT rule.

Tip #1: Be Enlightened of the Rule from the Starting time

There'southward so much misinformation surrounding the PDT dominion. Some people avoid trading altogether because they presume you lot need over $25,000 to be a trader while others only observe the dominion later they become their accounts locked.

If you're reading this post at the beginning of your trading career, you take an advantage.

The first step towards trading under the PDT rule is accounting for its existence. You demand to recognize this constraint before entering the trading arena. It'south just another rule of the game.

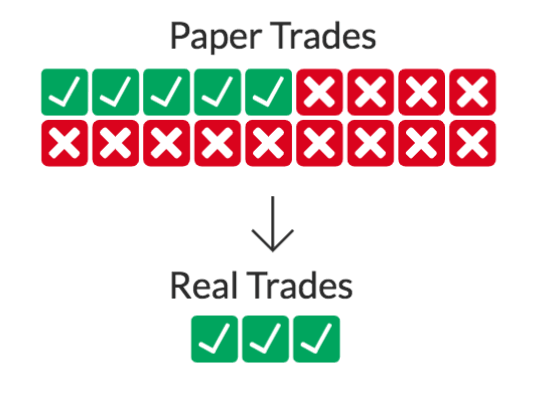

Keep this in mind during your newspaper trading phase (the phase at which you trade in a "virtual" account) every bit this is where many traders get in trouble. They start with a $100,000 virtual portfolio, identify dozens of trades per day, and overvalue their "virtual" success. When it comes fourth dimension to merchandise with real money, that $v,000 account just tin can't seem to match the performance of the $100k virtual business relationship. This doesn't fifty-fifty speak to the differences betwixt trading with real and virtual currency (as discussed hither). It relates to strategy.

This trader spent his learning menstruum trading like a hotshot and lost touch on with reality. Instead, this trader should have focused on developing afeasible strategy would carry over to trading with existent majuscule.

Of form, this doesn't mean you need to paper merchandise under the PDT rule; it would be foolish to limit your education. But go along this dominion in mind so you can develop a practical strategy.

Use paper trading to discover your strengths and weaknesses before yous put existent money on the line. Once you identify some of your strengths, you can brainstorm testing them at a pocket-size scale with real majuscule. The PDT dominion may even work in your favor, which leads us to the next point.

Tip #ii: Use the PDT Rule to "Strength" Quality Trades

Near traders would benefit from valuing the quality of their trades over the quantity . New traders should be fifty-fifty more selective as they are dealing with lower average win rates. If the odds are against you in every trade, it's not in your best involvement to compound these probabilities.

The PDT rule forces you lot to exist selective with your trades. When trading under this rule, it's your responsibility to cull your 3 all-time trades every week. Imagine if you had to practice this in other areas of your life, such as limiting your Tv set-fourth dimension to three hours per week, limiting your gym sessions to 15 minutes, or your email/phone time to ten minutes per day.

These restrictions, while seemingly obstructive, actually promote efficiency. If you know y'all only have x minutes to accomplish something that unremarkably takes 30, you're likely to increase productivity. Similarly, if yous need to achieve results from 3 trades every week, you're probable to increase the quality of each merchandise.

This is a not bad habit to adopt at the beginning of your trading career as it will enforce the principles of patiences and selectiveness.

The PDT Dominion tin too take some of the pressure off of new traders. You lot don't demand to principal trading overnight. You just need to place three good trades every week.

Tip #3: Use Multiple Entries OR Exits

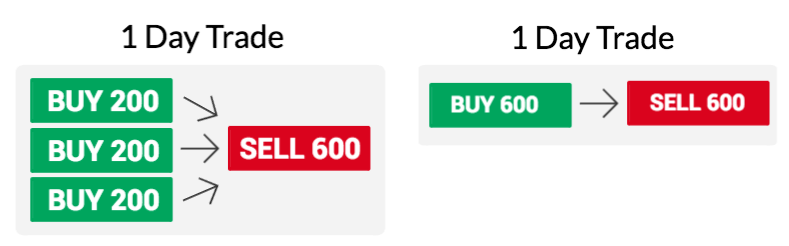

Tip #3 is a quick one. Information technology's a reminder that the PDT rule restricts round trip trades. A round trip is where you purchase and sell in the same twenty-four hours.

Under this rule, you can still have multiple entries with one get out or multiple exits from one entry. For example, yous could buy 3 lots of 200 shares, and sell 600 shares to leave the merchandise or vice versa. This can be constructive for traders who experience pressured to get "all in" in fear of wasting a day merchandise.

Important Note: Different brokers may have dissimilar definitions of "circular trips." Make certain to check with your broker before utilizing this strategy. Some brokers let one entry with multiple exits while others allow multiple entries with i exit.

Tip #4: Swing Trade

If yous're trading with less than $25,000, it'due south probable yous have other responsibilities during market place hours (i.e. schoolhouse or work). If this is the example, day trading may not exist your best pick.

Placing intraday trades on the job can be stressful especially when dealing with highly volatile stocks. Part-time traders may have improve luck with swing trading (i.eastward. ownership and selling over a few days or weeks). Swing trades do non count towards round trips under the PDT Rule, meaning traders can take advantage of short-term price activity without limitations.

Another benefit of swing trading is that the percentage returns can be higher, which is great for smaller accounts. The list of stocks that make 10% moves over a ane-week timeframe is much longer than the list of stocks that make like moves intraday.

Mutual Methods of Circumvention

In the commencement three tips, we discussed how traders can use the PDT Rule in their favor.

If you're dead set on bypassing the dominion, there are a few options. Annotation, that these methods are not recommended in most cases and the three tips above volition exist far more effective over the long run.

Utilize a Cash Account

The PDT rule applies to margin accounts, but not to cash accounts. The do good of margin accounts is that they allow you to "infringe" money, whereas cash accounts are similar to banking concern accounts.

Margin has iii master uses:

- Leverage Majuscule (i.e. 4:1 buying ability)

- Short sell stocks

- Avoid trading with unsettled funds

The terminal two uses are the near important, as new traders shouldn't be using leverage anyway.

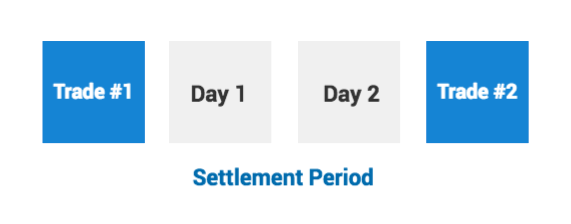

If you use a cash account, you volition not exist able to short stocks or merchandise with unsettled funds, which could be a dealbreaker. Fifty-fifty if yous take no involvement in short selling, waiting for funds to settle could have the same touch as trading under the PDT Rule.

For instance, if y'all buy a stock for $5,000 and sell it for $five,100, the proceeds need to settle for ii days before you can trade with that $5,100 once again. If that $v,100 represents all of your upper-case letter, you won't exist able to trade at all during the settlement menses of two days. Failure to attach to this rule will upshot in a xc-mean solar day lock on your account.

Note: You lot can BUY stocks with unsettled funds, only y'all cannot SELL those shares until the funds are settled.

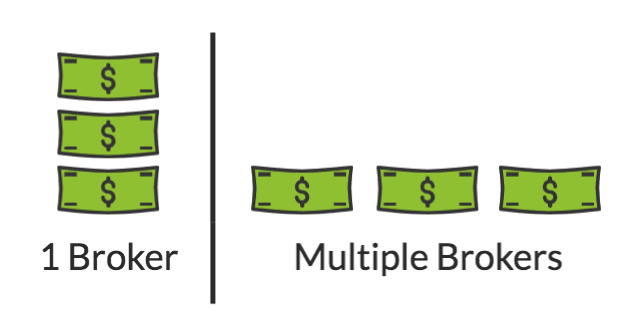

Employ Multiple Brokerage Accounts

New traders tin split their capital across multiple brokerage accounts. For example, you could have $2,000 at Ameritrade, $2,000 at ETRADE and $2,000 at Schwab. Each account would grant you lot an boosted three round trip trades, as they would be independently subjected to the PDT dominion.

The obvious downsides are:

- Managing multiple accounts can exist tedious and/or confusing

- Y'all limit your ownership power in each account (i.due east. y'all have buying power of $2k in three accounts vs. $6k in one business relationship).

Utilize Offshore Brokers

Some brokers have been able to circumvent the PDT Rule past establishing themselves offshore. Since these companies are not US-based, they are not required to adhere to the PDT dominion.

Make sure to do your research equally some of these firms charge exorbitant fees and/or may be sketchy.

For more than info on brokers, make certain to sentry this full guide:

Final Thoughts

As a trader under the PDT dominion, you take the pick to take it or circumvent it. In 99% of cases, accepting the rule is your best bet.

Almost every successful trader started out with a smaller account and earned his/her stripes. Be patient and work on refining your arts and crafts.

As much as traders like to notice scapegoats for their underperformance, the PDT Dominion will NOT make or break your success equally a trader.

If you lot're fortunate enough to find yourself in the minority of traders who make a living from the markets, you the PDT rule is aught more than a temporary hindrance. Accept it and focus on what's important - your trading performance.

Source: https://www.investorsunderground.com/pattern-day-trader-rule/

0 Response to "Pdt Rule if You Buy and Sell and Buy Again Does It Count as 2 Day Trades"

Postar um comentário